One evening not too long ago, I watched a young man pay for groceries in Nairobi without touching a single coin or card. He tapped his phone once, smiled at the cashier, and walked away with his shopping. What struck me was not the speed of the payment, but the fact that ten years ago this scene would have looked like science fiction. That is the quiet revolution we live in today: money is no longer just paper in your pocket, it is code running through invisible rails. Technology and finance are not separate industries anymore; they are one system rewriting how the world saves, spends, borrows, and grows.

You feel it when you send money instantly across borders without standing in a bank queue. You feel it when an app offers you a loan without asking for collateral. You feel it when your ride-hailing app quietly deducts a fare and sends the driver’s share directly. Finance has slipped into everyday technology so smoothly that many people no longer notice. But behind that seamlessness are forces worth understanding, especially if you are someone trying to protect your savings, grow wealth, or build a business.

Digital rails have lowered the cost of entry for businesses and customers alike. For the vegetable seller in Eldoret who used to rely on cash, mobile money means she can serve clients who never carry notes anymore. For the college student in Accra learning to code, the ability to freelance online and receive instant digital payments is not just convenience; it is livelihood. These shifts ripple across whole communities. Suddenly, people who were invisible to banks are visible to digital finance, and that visibility creates opportunities for credit, investment, and growth.

Of course, every new convenience carries a hidden layer of risk. One story that stuck with me was of a boda boda rider who lost his entire week’s income to a fraudulent SMS link. The money moved in seconds, irreversible. That is the double edge of technology and finance: what moves fast in your favor can move just as fast against you. Which is why the conversation must always include security. Strong passwords and multi-factor authentication are not tech jargon anymore; they are life jackets for anyone who earns or saves through digital systems.

Another transformation that deserves attention is how artificial intelligence quietly reshapes decisions behind the scenes. When you apply for a digital loan, an algorithm scans your patterns—how you use your phone, how often you transact, even how you pay your utility bills. A farmer in Kitale who never had a formal payslip may suddenly qualify for credit because AI sees stability in his mobile payments. But the same AI can also misjudge, carrying the risk of bias or unfair denial. For readers working in tech or finance, the lesson is clear: design AI with transparency and fairness, because these systems hold real power over real lives.

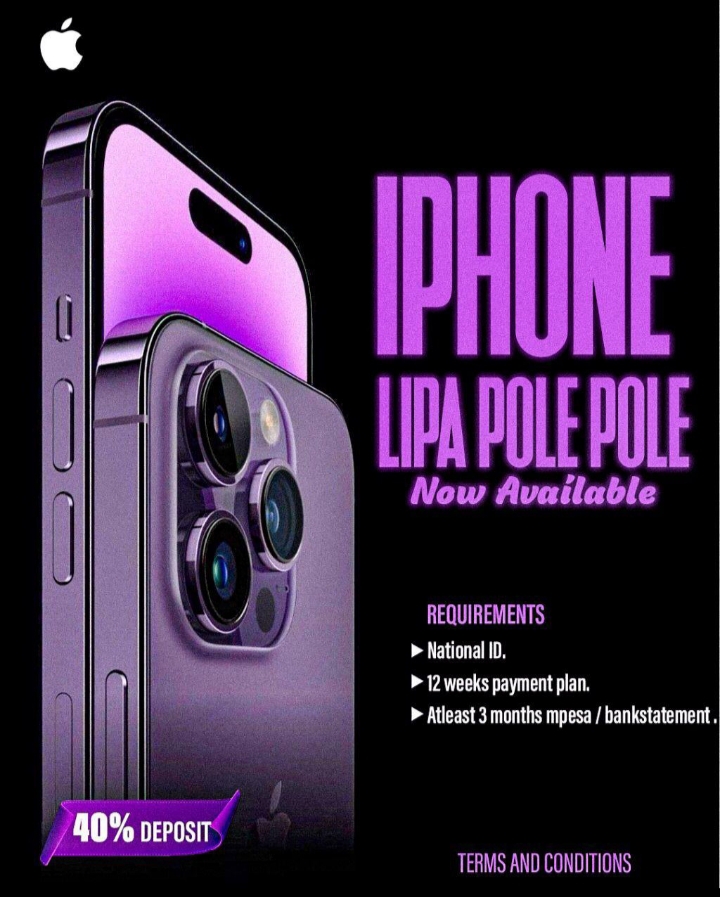

The smartest people I know in fintech tell me the real game is not just payments or credit, but embedding finance into everything else. Think about how you book a flight online. You do not think of it as using a financial service, yet behind that seamless checkout is an API connecting banks, payment processors, and airlines. For small businesses, this embedded finance is a game-changer. Imagine a farmer supply store offering instant “buy now pay later” through the same app you order seeds from. Suddenly, credit is not a trip to the bank; it is a button inside the service you already use.

But this growth also tests regulators. Governments cannot move as fast as code. Regulators worry about money laundering, fraud, and systemic risk. Entrepreneurs worry that heavy rules will crush innovation. The future will not be about choosing one side over the other but building bridges. Sandboxes, pilot programs, and collaborative oversight are tools that let new ideas breathe while protecting the public. For investors, regulatory clarity often separates hype from genuine opportunity. If you want to know which fintechs will last, look at who treats compliance as a design principle, not a checkbox.

There is also a deeper economic angle. When digital money replaces cash, the state loses part of its invisible hold over currency flows. That is why central banks from China to Nigeria to Europe are exploring digital currencies of their own. A central bank digital currency is not just another app; it is a new layer of monetary power. Whether these currencies succeed or stall, they will shape how nations control inflation, trade, and financial inclusion. For citizens, the takeaway is to stay informed. The way your government handles digital currency could affect the cost of living in ways bigger than you imagine.

Now, let us make this practical. Suppose you are an entrepreneur in Kenya building a delivery service. Embedding mobile payments into your platform is not optional; it is survival. But go further. Offer a loyalty wallet that rewards customers with points they can spend on future deliveries. Partner with a local lender to give your riders instant micro-loans for fuel, repayable from their daily earnings. You are not just running logistics anymore—you are quietly becoming a financial ecosystem. The companies that thrive in the next decade will be those that think this way, merging tech and finance into experiences that feel natural to the user.

Suppose you are a professional building a career. Do not lock yourself into one box. The future belongs to translators—people who understand both finance and code, who can sit with engineers in the morning and compliance officers in the afternoon. Learn how APIs work. Learn how to read a balance sheet. If you can bridge those worlds, you will always be in demand.

And suppose you are just a consumer, trying to make smart choices. The best habit is caution. Stick to regulated platforms. Read the fine print on fees and dispute policies. Diversify your financial tools so you are not locked into one service. Always test a platform with small amounts before moving large sums. And never forget: technology may evolve, but financial discipline remains timeless. Save a portion, invest wisely, and treat every “too good to be true” offer as exactly that.

So where does this story end? It doesn’t. Technology and finance will continue to merge in ways we cannot fully predict. What we can control is how we engage with it. With curiosity instead of fear. With discipline instead of greed. With design rooted in security and inclusion, not just speed. Those who understand this balance will not only protect themselves but also unlock opportunities that others overlook.

The next time you tap your phone at a shop counter, remember: you are not just making a payment. You are participating in one of the biggest shifts in human economic history. The handshake between code and currency is invisible, but it is already shaping your future.

Comments (0)