It starts innocently — a small loan from a mobile app to buy airtime or clear a bill. The repayment is delayed, and another app steps in. Within weeks, you’re trapped. Your salary is swallowed before it lands. Sound familiar?

This is not fiction. It’s the daily financial nightmare for millions of Kenyans, especially the youth. Mobile loan apps — once hailed for financial inclusion — have silently become predators in people’s pockets.

The Rise of Instant Loans in Kenya

Kenya’s fintech space has exploded over the last decade. Today, platforms like Tala, Branch, Zenka, Okash, Opesa, KCB M-PESA, Fuliza, and more offer loans within minutes. No paperwork. No guarantors. Just your phone, and a click.

According to the Central Bank of Kenya, over 7 million Kenyans have accessed digital credit. But what most don’t see is the interest rates hidden behind convenience.

What They Don’t Tell You

Let’s break it down:

Most mobile loans carry annualized interest rates of 100% to 500%.

Missed payments can lead to shame-based SMS reminders, sometimes even to your contacts.

CRB blacklisting affects your future — job applications, SACCO loans, mortgages.

A Ksh 1,000 loan can cost you Ksh 1,300+ in less than 14 days.

This is not financial help. This is legal exploitation.

The Psychological Trap

Digital debt doesn’t just hurt your wallet — it affects your mind.

You start borrowing to pay other loans (debt cycling).

Anxiety builds as repayment dates approach.

Guilt and shame make you avoid friends, opportunities, and even your own dreams.

It becomes a lifestyle — one where you're always in a race you can’t win.

Why Young Kenyans Fall for It

1. Unemployment and underemployment

With few income sources, youth use loans to survive.

2. Peer pressure and lifestyle comparison

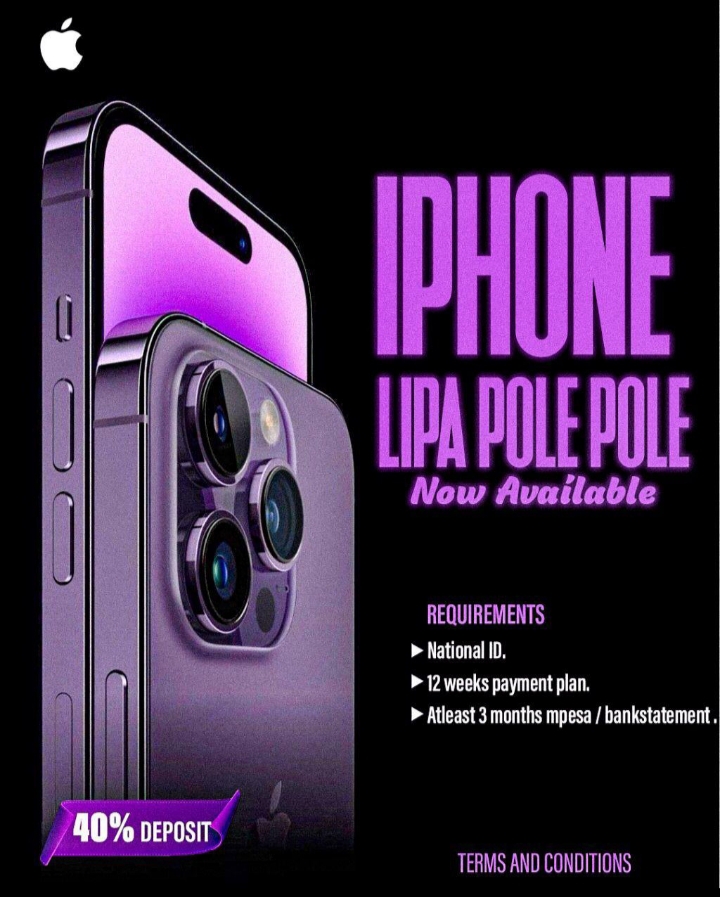

The pressure to “fit in” or “keep up” leads many into reckless borrowing.

3. Lack of financial literacy

Many borrowers don’t read the terms or understand interest rates.

4. Instant gratification culture

Why wait when an app can give you what you want now?

Real Stories, Real Pain.

Ask around — you’ll hear stories of people who:

Borrowed Ksh 500, repaid Ksh 5,000 after penalties.

Were blacklisted and couldn’t access HELB or job opportunities.

Developed mental health issues from debt pressure.

Mobile debt ruins lives silently.

How to Break Free

Escaping digital debt starts with intentional action:

Delete loan apps from your phone.

Track all your loans and create a realistic repayment plan.

Join a SACCO or chama to build real savings and credit access.

Start a side hustle, even small, to ease pressure.

Seek mental and emotional support if debt is overwhelming.

Better Alternatives Exist

Instead of falling into the mobile loan trap, consider:

Saving through M-Shwari Lock or SACCOs.

Using digital budgeting apps to manage cash.

Building an emergency fund — slowly but consistently.

Borrowing only from regulated financial institutions

“Don’t borrow for comfort today and pay with chaos tomorrow.”

Kenya’s youth are bright, talented, and driven. But the convenience of mobile loans is enslaving a generation. If you’re in that trap, you’re not alone — but you must act. Debt should not be your lifestyle.

Freedom is possible. It starts with one decision:

Say no to digital debt, and yes to financial discipline.

Reader Responses (0)