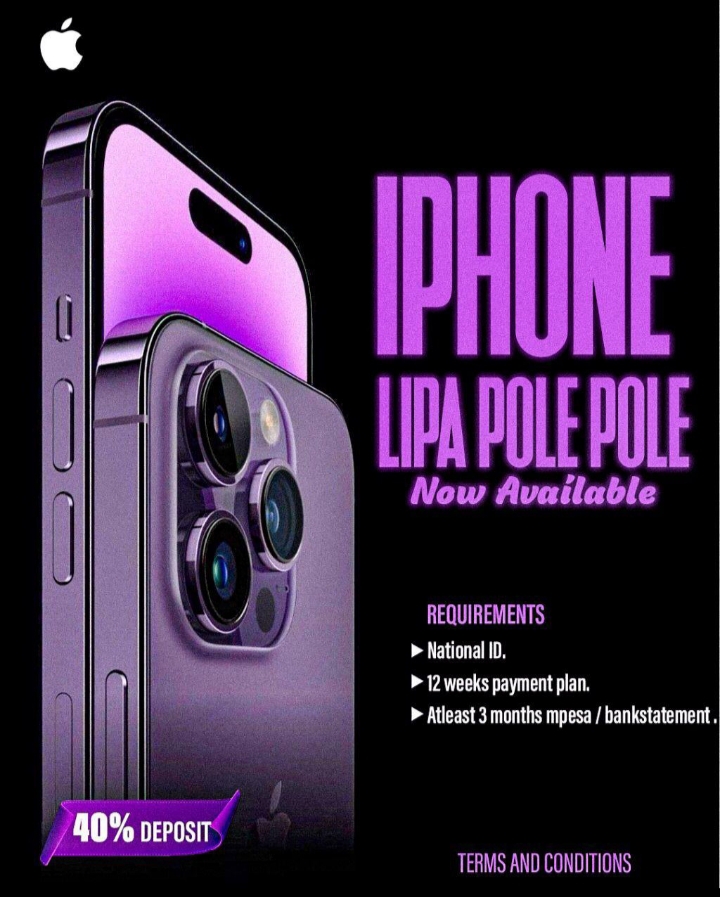

The Rise of Lipa Pole Pole

In Kenya, financial ingenuity has always been a survival skill. Over the past decade, a payment system known as “Lipa Pole Pole”—which translates to “pay slowly”—has been quietly revolutionizing consumer habits across the country. Unlike traditional upfront payments, this approach allows individuals to purchase essential goods and services in small, manageable installments. This system has become a cultural and economic game-changer, influencing spending behaviors, financial responsibility, and even the way young adults approach independence.

Mobile money platforms such as M-PESA have played a pivotal role, enabling secure daily or weekly payments. From urban centers to rural villages, the system has made it possible for households to access products and services without depleting their entire savings, creating both financial flexibility and empowerment. The shift is not merely transactional; it reflects a deep cultural adaptation that merges tradition with modern technology.

How Lipa Pole Pole Works in Daily Life

For many Kenyans, Lipa Pole Pole is more than a financial tool—it’s a lifeline. Grace, a mother of three in Nairobi, explains:

“I wanted a refrigerator to keep food fresh, but paying upfront was impossible. With Lipa Pole Pole, I could pay a little each week and have it at home immediately.”

Similarly, Joseph, a small business owner in Kisumu, relied on the system to buy a new batch of stock:

“Paying in installments allowed me to keep my business running without depleting my working capital. It’s a relief for entrepreneurs like me.”

Even in rural areas, farmers have adopted the system to buy seeds, fertilizers, or small farming equipment. The incremental approach aligns with seasonal incomes and cash flow realities, making it a practical solution for low-income earners. Vendors, too, have embraced this change: local shopkeepers now offer Lipa Pole Pole plans to attract more customers, knowing that small installment payments increase accessibility and sales.

Cultural Context: Why Lipa Pole Pole Resonates

Kenya has a long-standing tradition of incremental financial responsibility. Practices such as chamas (community savings groups) and informal lending have been part of everyday life for generations. Lipa Pole Pole builds on this cultural foundation, blending tradition with modern digital technology.

Where borrowing in the past could carry social stigma, structured installment payments are now socially accepted. The system reflects Kenyan values of careful planning, patience, and gradual progress. It’s no longer just a financial method—it’s a cultural norm, teaching lessons about responsibility and independence. Parents often see it as a practical tool for teaching their children about budgeting, while young adults appreciate it for the sense of control it provides.

Benefits for Individuals and Communities

The advantages of Lipa Pole Pole are numerous:

- Financial Inclusion: People without access to traditional banking can still participate in commerce.

- Empowerment: Small, manageable payments give a sense of control over one’s finances.

- Entrepreneurial Support: Small business owners can acquire inventory or tools without large upfront costs.

- Digital Literacy: Increased use of mobile money platforms enhances familiarity with digital financial tools.

- Cultural Alignment: It reinforces values of patience, budgeting, and incremental progress.

Peter Mwangi, a financial analyst in Nairobi, adds:

“Lipa Pole Pole teaches budgeting, prioritization, and responsible spending. It’s not just a payment system—it’s a financial education mechanism.”

Real-Life Examples: Stories of Change

In Eldoret, a young student named Alice used Lipa Pole Pole to purchase a laptop for online learning. By paying small weekly installments, she avoided debt traps and could access technology essential for her studies. In Mombasa, local artisans are using the system to invest in raw materials, allowing them to expand their micro-enterprises while maintaining a steady cash flow. These stories highlight how the system empowers ordinary people to achieve their goals without waiting for large lump-sum payments.

Potential Risks and How They Are Managed

Despite its benefits, the system is not without risks. Consumers may overcommit, underestimate cumulative costs, or miss payments. Some providers may impose hidden fees, and lack of financial literacy can lead to defaults.

To mitigate these issues, transparent agreements, community financial education, and responsible lending practices are essential. Digital platforms have started sending reminders, offering budgeting tips, and clearly displaying installment schedules. With proper oversight, Lipa Pole Pole remains a tool for empowerment rather than a source of financial stress.

Changing Consumer Behavior

The system is reshaping how Kenyans think about purchasing:

- Immediate Access: Products can be used while payments are ongoing.

- Planned Spending: Installments encourage budgeting and financial foresight.

- Entrepreneurial Confidence: Young adults can invest in businesses without full upfront capital.

- Cultural Reinforcement: The system upholds values of responsibility and incremental progress.

Young consumers now view delayed payment as both practical and responsible, shifting societal attitudes toward modern financial management. The habit of budgeting monthly payments encourages long-term planning and reduces impulsive spending.

Broader Economic Implications

Lipa Pole Pole is influencing Kenya’s economy beyond individual households. By increasing purchasing power, it stimulates demand, supports small businesses, and encourages adoption of digital payments. Marginalized communities gain access to essential goods, improving quality of life.

Moreover, it fosters financial literacy and responsibility, reducing reliance on informal or predatory credit sources. This incremental approach aligns economic growth with social values, promoting long-term stability. As businesses track payments and customer behaviors, they can tailor services to meet demand efficiently, creating a more responsive market ecosystem.

Expert Perspectives

Economists and financial advisors note that incremental payment systems like Lipa Pole Pole also encourage innovation. Mobile developers design user-friendly interfaces to track payments, while banks and microfinance institutions collaborate to expand digital access. According to Mercy Oduor, a financial educator in Nairobi:

“Systems like Lipa Pole Pole not only change how people pay—they change how people think about money. It’s teaching patience, planning, and responsibility.”

Personal Reflection

The Lipa Pole Pole system demonstrates how cultural norms can adapt to modern needs. It emphasizes patience, planning, and careful decision-making, all while providing tangible financial benefits. It’s not merely a tool—it’s a reflection of Kenya’s evolving relationship with money, responsibility, and independence. By observing these small, consistent payment behaviors, young adults are internalizing lessons about budgeting and delayed gratification that will benefit them for life.

Lipa Pole Pole has quietly reshaped consumer behavior in Kenya. By enabling gradual payments, the system provides financial access, promotes responsible spending, and supports both households and entrepreneurs. It represents a blend of traditional wisdom and modern innovation, empowering individuals while reinforcing cultural values.

How do you think incremental payment systems like Lipa Pole Pole will influence the future of consumer habits in your community? Reflect on this change and consider the lessons it teaches about patience, responsibility, and financial empowerment.

Reader Responses (0)